Income Tax, Social Charges and Health Insurance for a Czech Trade License

All of the below information comes from a Tax optimization / Financial Planning model which will be used during a business consultation for your specific situation.

It can calculate

- ONE Trade License using pausalni dan, real expenses or 60/40 method,

- TWO Trade Licenses for partners using pausalni dan, real expenses or 60/40 method,

- one or two Trade License(s) versus an SRO,

- one or two Trade License(s) in combination with an SRO,

- Trade License versus SRO versus Offshore Business,

- with various Revenues / Expenses in CZK / EUR / USD

- with other sources of (foreign) Income Revenues

- for all expats in Czech Republic, for all residence permit / visa types.

If you book a consultation, you will get your own set of pdfs based on your busines costs / revenue + a lot more information about doing business in CZ / visa & residence permits, banks, foreign income, VAT, bi-lateral tax agreements etc etc.

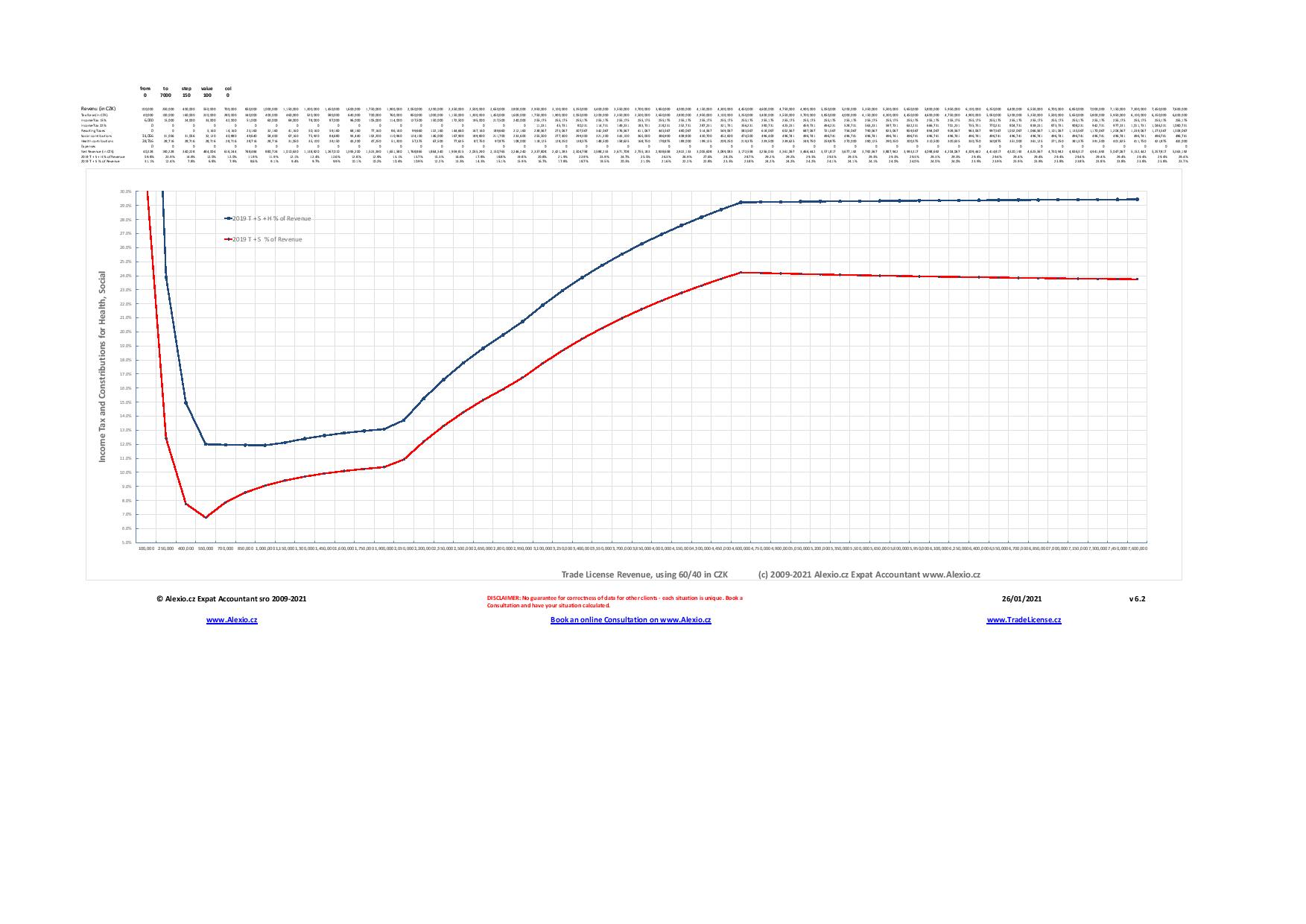

In the Graph below you will see Tax / Social / Health contributions for a Trade License using 60/40 for revenue between 0 and 7 M CZK annually:

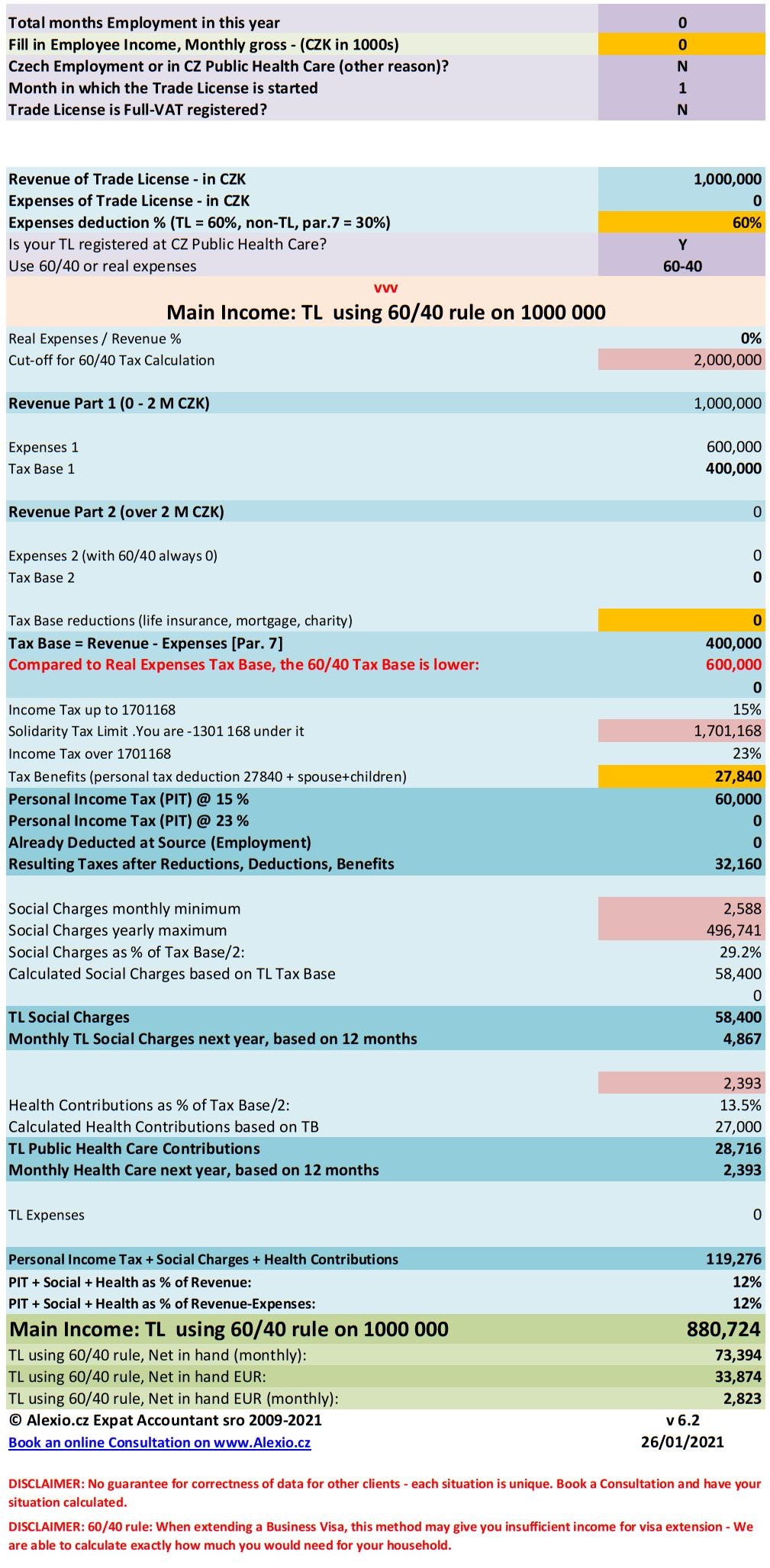

Here is an example of a Trade License using the 60/40 rule, with 1 M CZK Revenue:

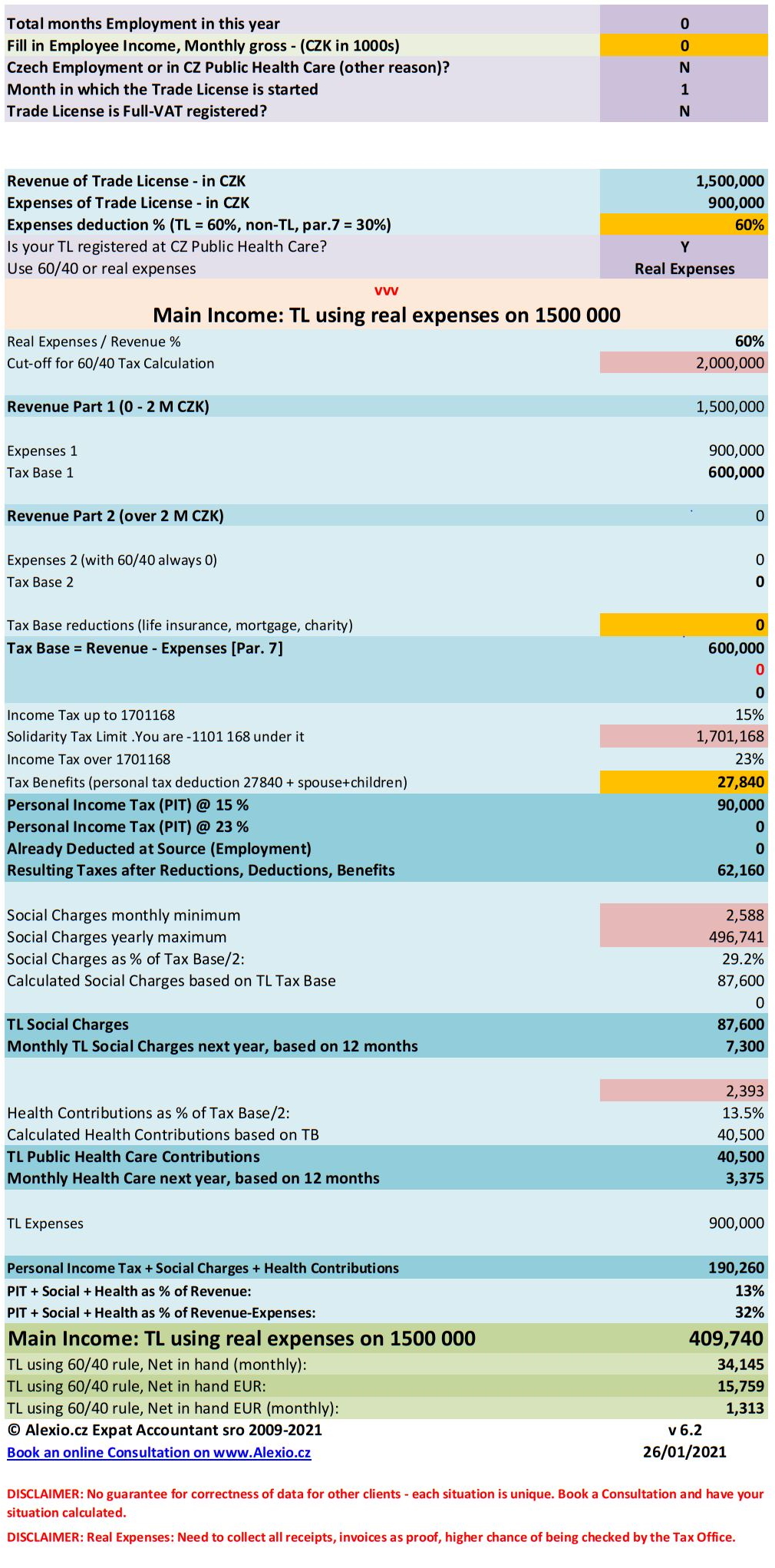

Here is an example of a Trade License using real expenses, with 900K expenses and 1.5 M CZK Revenue:

Continue to: Contact Us / Address Info